What is Mint app?

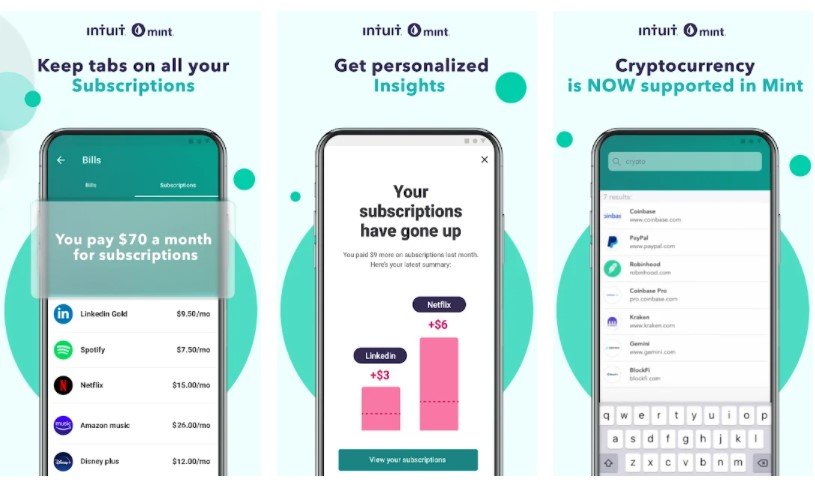

Mint app enables you to manage all of your finances in one location. All your financial information is now accessible in a single place, from balances and budgets to credit health and financial goals. Mint enables you to manage all of your financial transactions, budgets, expenses, and subscriptions in a single, convenient location.

Be notified when you’re on the verge of exceeding your budget and before you overdraw an account. Subscribers will be notified when subscription prices increase, and expired subscriptions are discovered.

Everything you need to know about your finances and spending in one convenient location: your credit card balances and transactions is just a tap away. Mint provides a complete picture of your financial well-being by aggregating information ranging from account balances to monthly spending to net worth and your free credit score. Bring all of your financial assets together into a single financial portfolio.

Main Highlights

- Credit monitoring and fraud alerts can all be done from the same app.

- Bills and bank balances can be viewed side-by-side.

- To avoid overspending, use the bill tracker to keep an eye on your finances.

Features of Mint app

- Using TurboTax, you can check your refund status and get an estimate of when it will arrive in Mint.

- Using our budgeting app, you can set specific financial goals and receive personalized advice.

- You’ll be able to track your progress and be proud of it with the help of money management tips.

- You can access your free credit score and credit report whenever you log in.

- In one app, you can monitor your credit score and get alerts for identity theft and fraud.

- Bills can be viewed right alongside the balances in your bank account.

- With the help of the bill tracker, you can keep an eye on your finances and avoid overspending.

- In addition, sign up for bill reminders so that you can avoid late fees.

Why choose Mint app?

It is possible to improve your spending habits by setting personalized goals that keep you motivated. Get rid of your debts and put some money aside for a down payment on a new home. You can keep track of every penny that passes through your hands with a few simple clicks on your computer’s mouse.

Mint App Reviews

Frequently Asked Questions

- In terms of my bank accounts, what’s the latest?

Some banks use OAuth technology to connect to Mint more securely. To add these financial institutions to Mint, you won’t be required to enter your email or password. Instead, you’ll be redirected to the website of your bank to authorize Mint to access your financial information.

As soon as your bank implements OAuth, we’ll notify you. We’ll walk you through the process of updating your account so that it continues to function.

There are several ways to improve your search results:

Make sure you’re looking for your bank by typing in the name exactly as it appears on the website. For instance, 1st Advantage instead of First Advantage. Instead of searching for the generic term “credit card issuer,” look for the company’s name on the back of your card. Instead of Visa, you could use Chase, MBNA, or Bank of America.

- How do I set up a new account in Mint?

Add your bank, biller, or other financial institution to your Mint account by following these instructions. A manual offline account is required to add your real estate, vehicles, offline loans, assets, and other possessions. When you open the Mint app, tap the plus sign at the top right of the screen.

Select the Add Account option. Enter the financial institution’s name into the search field and select it. Any additional information requested can be entered here. Add the account using the same username and password that you use on that financial institution’s website. When you add a new bank account to Mint, it automatically downloads the last 90 days’ transactions’ worth.

Mint App Download

Like our Mint App ReviewMint App Review? Check out more Mobile App Reviews or Submit your own Mobile App Reviews.