What is Bright App?

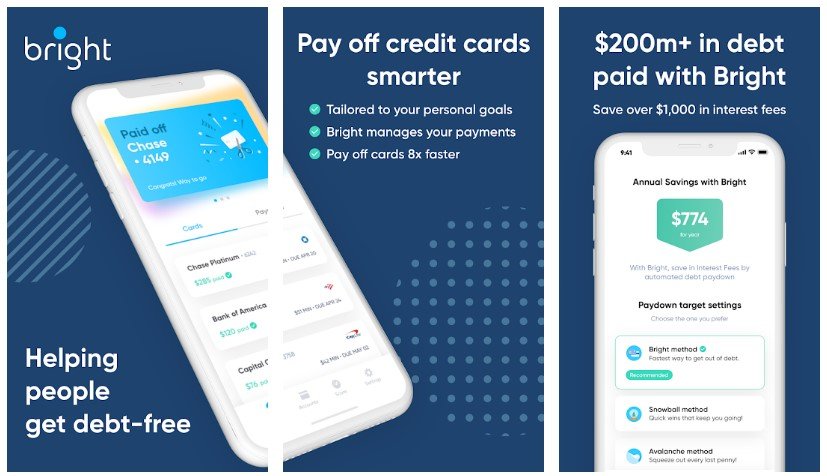

Bright is a smart solution that uses automation and artificial intelligence to help you pay off your credit card debt on schedule and quickly. Bright A.I. examines your spending habits, income, and credit card balances. It then creates an optimum payment plan based on your specific scenario. Upcoming Payments can be viewed from the app’s dashboard.

Avi Patchava and Petko Plachkov founded Bright after realizing how expensive credit cards are for users. Bright also has a Bright Credit line that may be used to consolidate and pay off credit debt quickly and easily.

Your Bright Account is a safe financial account where you can deposit funds for credit card payments. You can either withdraw monies to your checking account or allow Bright to utilize these funds to pay your credit card payments promptly, saving you interest and fees. You have complete control over the funds in your Bright account.

Main Highlights

- Take charge of your financial situation.

- Payment protection insurance.

- All accounts are managed via a single app.

Features of Bright App

Features of Bright App

- Bright determine the appropriate amount of money to begin collecting for your credit card payments.

- It takes into account all of your minimum dues and balances on all of your credit cards.

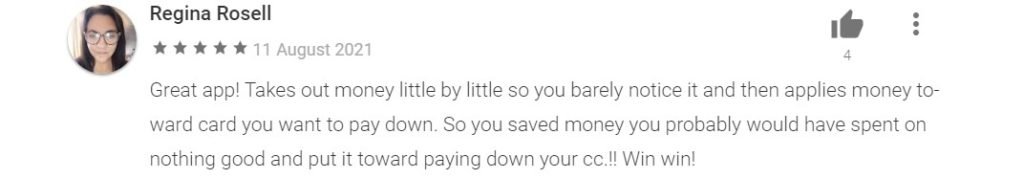

- Bright withdraws funds from your primary checking account every 2-3 days, ensuring that your payments are made on schedule and that you are not hit with a large bill all at once.

- Bright will automatically organize your payments for all credit cards.

- Your money is collected in your safe Bright Account and utilized to pay down your credit cards.

- You may always use the app to withdraw and reverse payments from your Bright Account.

- You can establish a monthly goal for the payment amounts you want Bright to handle if you want us to stop collecting money for you for a specified period of time.

- View all of your credit cards and bank accounts in one location.

- Create a bespoke plan that is tailored to your specific financial needs.

- Keep track of your impending bills and set them to be paid automatically.

- You will receive updates on your progress and savings.

- Obtain bank-level security.

Why choose Bright app?

Banks are offering increasingly complex products that frequently do not serve the best interests of their customers. Hidden fees, teaser rates, and enigmatic jargon. Bright works on your behalf to determine the best approach to manage your money without you having to do any work. As a result, you’ll have more control over your finances, fewer financial worries, and more money in your pocket.

Bright App Reviews

Frequently Asked Questions

- How does Bright determine the average potential lifetime savings?

Bright analyzes potential interest savings by examining average credit card APRs across the United States (source Wallet Hub) and assessing the impact of paying an extra $100 per month toward credit card balances over five years.

Bright determined that the majority of Bright customers could pay an extra $100 per week for a month. Bright assumed that any interest savings would be reinvested in additional debt pay down, hence accelerating debt pay down and resulting in interest savings.

- Bright does not have any of my cards. What am I supposed to do?

Bright accepts payment cards with 13 to 19 digits that are active or open. Is your credit card included in this category? If it does not, please contact them via the Live chat window or email at support@brightmoney.co.

- How does Bright help users save money?

Bright evaluates possible interest savings based on debt reduction. These are calculated yearly, and lifetime savings estimates are based on information for consumers who joined us between January 2020 and March 2021. Bright’s intelligent technology makes debt payments on its users’ behalf, ensuring that high-interest debt is paid down first.

The estimated pay-down objective ensures that the user pays more than the minimum due. The difference between paying Bright’s payment objective and paying only the minimum is used to compute the average potential savings. It is assumed that the debt does not grow over time. Savings will vary depending on a variety of circumstances, such as payments made, credit card balances, APRs, card charges, and other activities.

- How is Bright’s payment system calculated?

Bright computed paydown projections in April 2021 using data from consumers who enrolled between January 2020 and March 2021. We estimated the users’ income and costs, and Bright’s systems calculated a paydown objective for each user based on a variety of parameters, including the user’s checking account balance, spending habits, and regular bills.

Bright App Download

Like our Bright App Review? Check out more Mobile App Reviews or Submit your own Mobile App Reviews.